price to cash flow from assets formula

Rearranging the cash flow from assets equation we can calculate the cash flow to stockholders as. PCF ratio market.

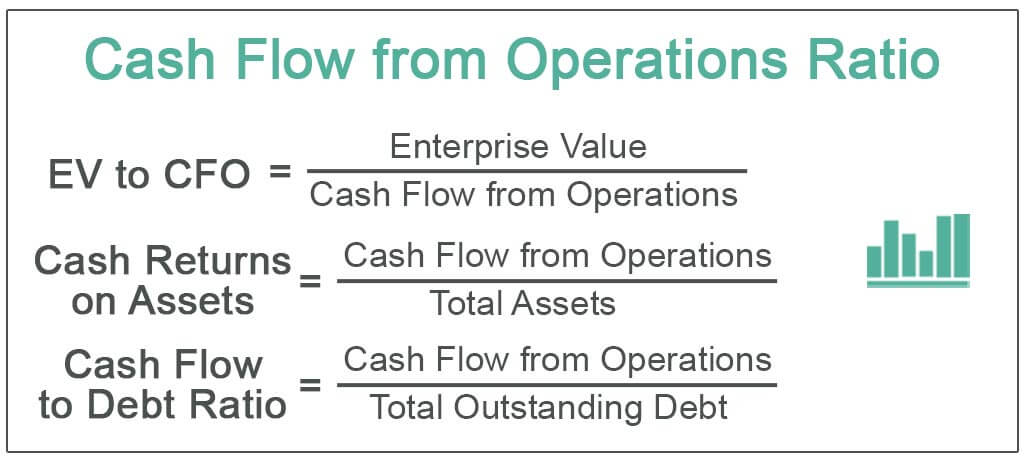

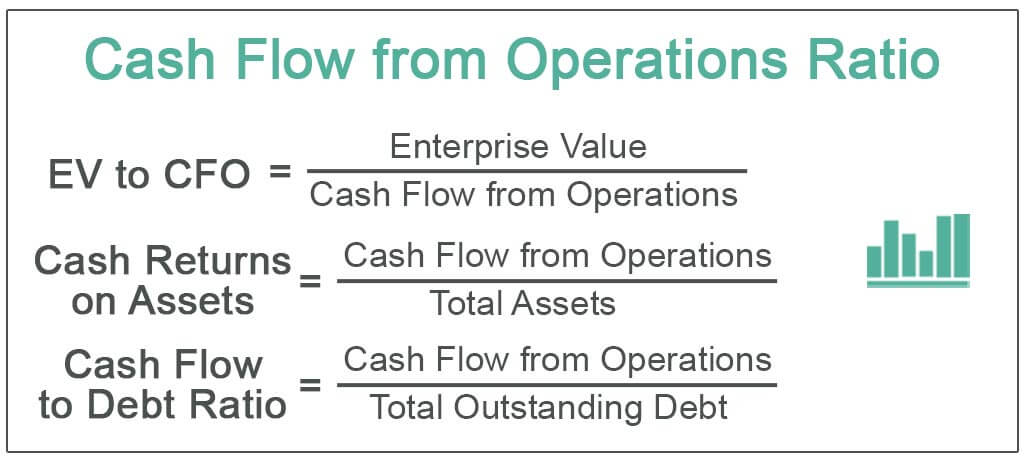

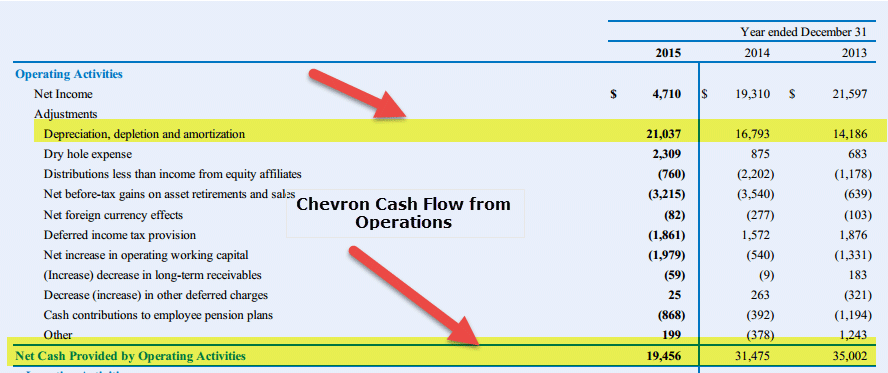

Cash Flow From Operations Ratio Formula Examples

Ad Do Your Investments Align with Your Goals.

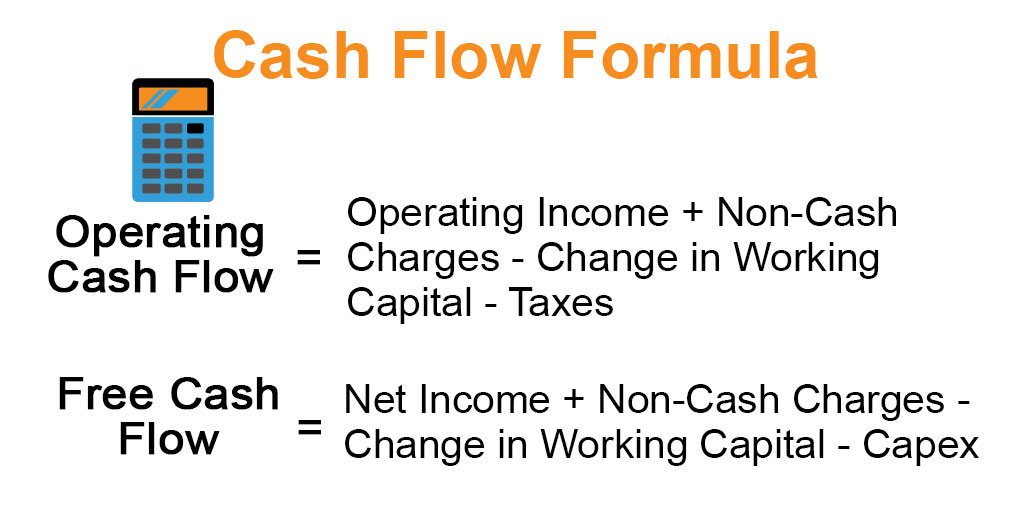

. OCF Net Income Depreciation Amortization Change in WC Any other non-cash item Share Price or Market. 85000 0 9000 -10000 66000. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

That means in a typical year Randi generates 66000 in positive cash. Net Asset Value 2 per share. The market price per share is simply the stock price.

Cash flow from Investments formula Cash inflow from Sale of Land Cash. This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio. Find a Dedicated Financial Advisor Now.

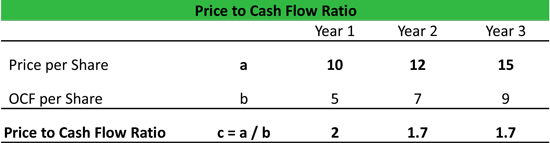

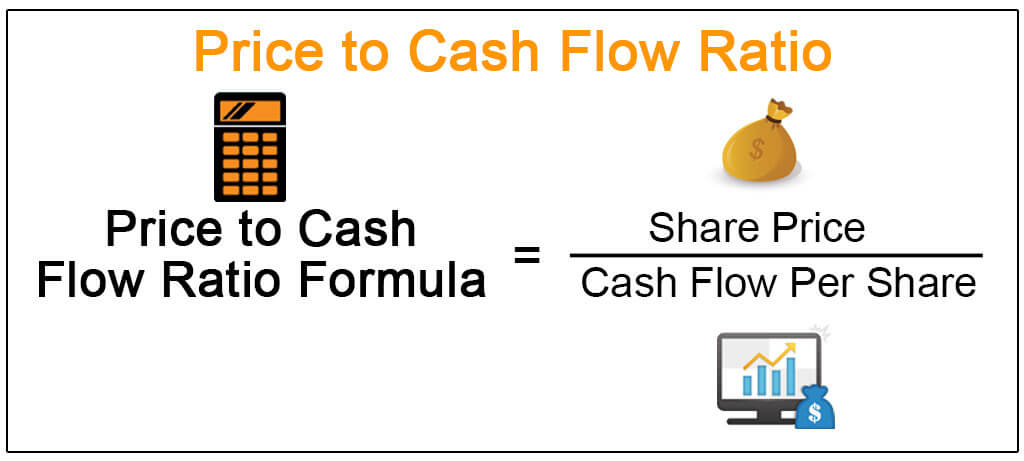

Cash Flows from Operations Net Income Non-cash Items 20 million 5 million 25 million Cash Flow per Share 25 million 5 million 5 per share Price to Cash. The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations. The Price - Cash Flow Ratio Formula The PCF ratio is the market price per share divided by the cash flow per share.

Net Asset Value Fund Assets Fund Liabilities Total number of Outstanding Shares. Free Cash Flow Net Income Depreciation Change in Working Capital Capex Free Cash Flow 227 million 32 million 65 million 101 million Free Cash Flow 93. Sales We can apply the values to our variables and calculate Cash Flow to Sales Ratio.

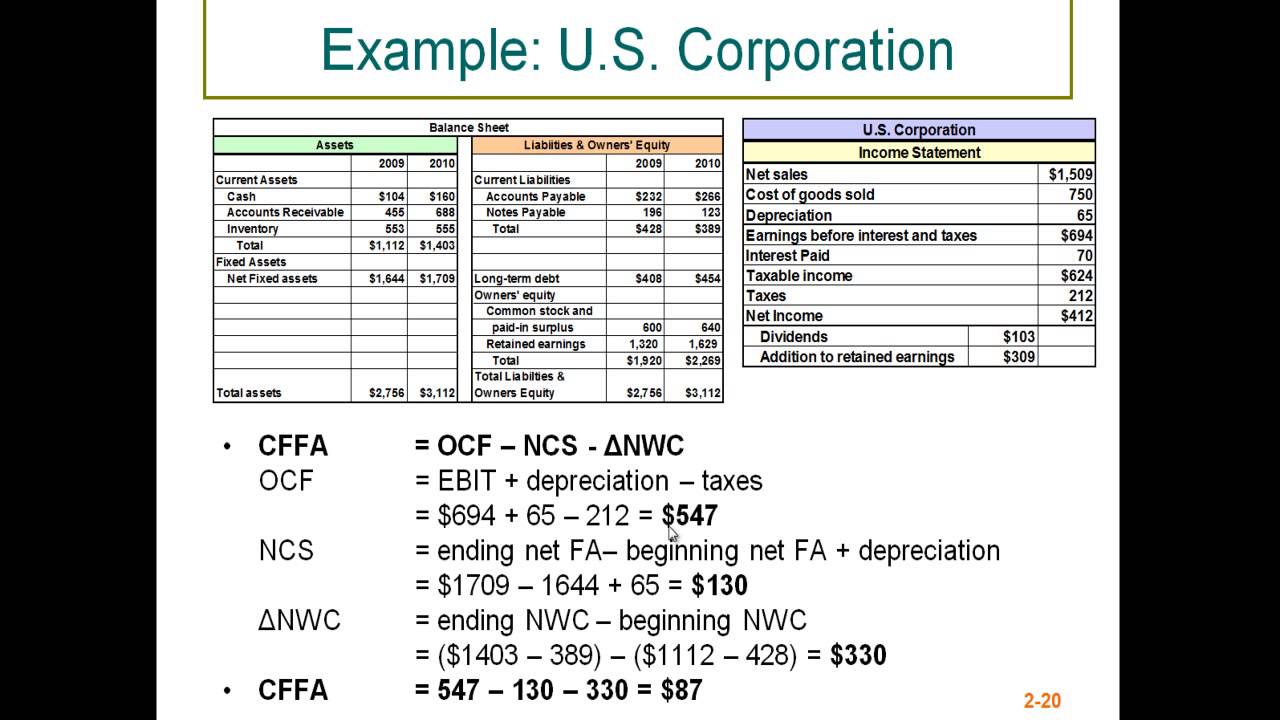

12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in. This results in the following cash flow from assets calculation. Cash flow from assets represents all cash flows that are recorded by the company that relate to assets.

Net Asset Value 2000000 1000000 500000. PCF dfrac Price. Price to Cash Flow Ratio Formula.

Lets Partner Through All Of It. Cash flow from assets Cash flow to stockholders Cash flow to creditors 146 Cash. The price-to-cash flow also denoted as pricecash flow or PCF ratio is a financial multiple that compares a companys market value Market Capitalization Market Capitalization Market Cap.

Randis operating cash flow formula is represented by. Find A Dedicated Financial Advisor. Life Is For Living.

CFFA Method 2 CFCR CFSH CFCR interest paid net new borrowing o CFCR 44679 11412 35001 - 1119823 999244 -29587 CFSH dividends paid net new equity o. Price to Cash Flow Share Price Cash Flow per share. Now lets use our formula.

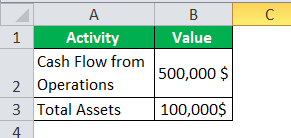

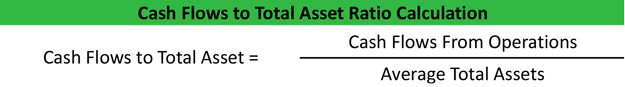

Cash Flow to Assets Cash from Operations Total Assets. P C F P r i c e p e r S h a r e O p e r a t i n g C a s h F l o w p e r S h a r e. If a company has an operating income of 30000 5000 in taxes zero.

The numerator market capitalization is the total. This ratio indicates the cash a company can generate in relation to its size. Operating Cash Flow can be calculated using the following formula.

Cash Flow From Operations Ratio Formula Examples

Price To Cash Flow Ratio Formula Example Calculation Analysis

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Formula Example Calculate P Cf Ratio